Having your credit card application rejected can come as a surprise. It is important to know that there are several factors that come into the publisher’s decision to say no.

While it can be disappointing, keep in mind that it can happen to anyone. In fact, some TPGers have been rejected for at least one card.

Before applying again, it is best to understand the factors behind the denial. Danyal Ahmed, a credit card writer at TPG, was rejected once, and he only motivated him to find out why and try again after dealing with areas that needed his attention.

Here are some reasons why your credit card application is rejected and how you can get approval next time.

What to know before applying a credit card

Publishers review credit card applications holistically. This means they see a variety of factors, and each publisher can evaluate the same applicants in different ways.

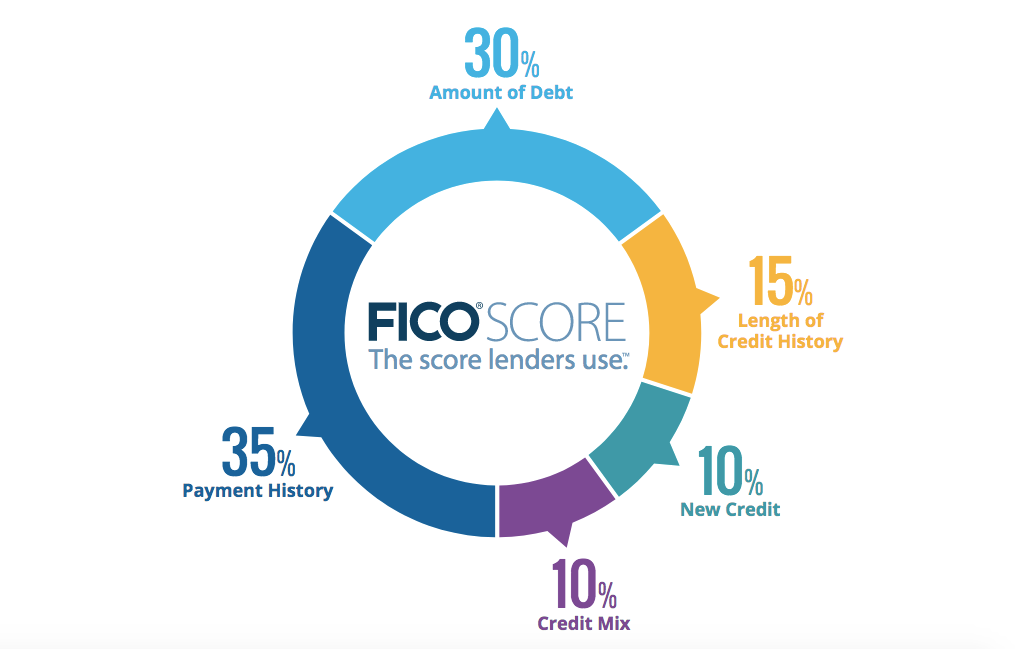

Applicants should intend to have Second -two good credit and long credit history. One of the most important factors is your payment history, which defines 35% of your overall score.

After submitting a credit card application, you will usually find that you have been approved in place. However, if you are denied, you should receive a letter within seven to 10 business days from the date of submission of your application.

If you are familiar with your personal credit history, you may be able to find out why you are not approved before receiving your letter with one of the explanations below.

Credit report error

The first step to take before applying for a credit card is to view your credit report. Check the number of accounts in your name and make sure they are in a good position. If you see the loan or the credit line You have not agreedYou may be the victim of identity theft.

Daily newsletter

Your Inbox Rewards with TPG Daily Newsletter

Join more than 700,000 readers for breaking news, in -depth guides and exclusive offers from TPG experts

Be careful for inaccurate personal information and reporting errors that affect your score. You can Check your credit report for free on YearCreditReport.com and dispute any mistakes you find to avoid the rejection of future credit.

Related: Credit card scam vs Identity theft – how to find out the difference

Insufficient credit history

Have a short credit history or cannot make you not eligible for a particular credit card. Your credit report should contain at least one active account to produce a FICO credit score. Without credit history, creditors cannot measure your credit eligibility and the possibility of you will Pay your balance.

Credit cards are not the only types of accounts that can be calculated towards your credit history. If you have a car payment or student loan, they can also count to build your credit history.

Credit card beginners should consider alternative options such as being Authorized Users or apply a secure card. This is a great way to build credit if you are under 18, as you are too young to apply for a card but can set yourself up for future success.

Related: Quick points: Have a good credit? Share with authorized users

Low income or unemployment

Credit card issuers do not publish minimum income requirements for their credit card, but if you do not have enough income (or anywhere), you may be at risk. This is because a credit card company cannot believe that you have the ability to pay all the debts you charge to the card.

Remember, you don’t want to lie about your income on a credit card application; Doing it can affect your application. Publishers can ask you to submit tax returns or pay STUBs to confirm your income. If you can’t prove that you get what you claim, you might be blacklisted by the publisher.

This means you will not be approved for any new card from the publisher, and your existing account can be closed.

Related: Selected for the American Express Financial Study? This is what is expected

Missed payment

Have a a weak payment history That means you may not be able to repay the outstanding balance, which can significantly drop your credit score. Depending on the payment, it can potentially maintain your credit report for up to seven years. If you are unable to make a payment or have a credit card debt, consider applying a Balance Transfer Credit Card to help manage your debt.

Related: How to save your credit score after late payment

Credit usage is too high

Running the balance from month to month indicates that you may not be able to pay your balance completely and may be at risk of violation. If your outstanding balance is too high, the publisher may hesitate to approve you.

Take care of you Credit usage rate below 30% It is best for your credit score as it shows you managing your credit card well and avoiding overspending.

If you use more than 35% of your credit limit, consider asking for an improvement from publishers. Just know that in some cases, this can cause a Hard inquiries about your credit reportBut most of the time, it’s a soft attraction. Before asking for an increase in credit online by phone or online, you will be notified if it is a difficult question.

Related: Credit usage ratio: what it is and how it affects your credit score

Too many new credit inquiries -this recently

Having too many questions about your credit report in a short time can result in a credit card application denial. Publishers can see a person with many questions in a short period of time as a risky borrower who needs money and may not be able to pay the debt responsibly.

There are two types of credit inquiries: hard and soft inquiries.

Hard investigations (also known as hard -to -pay) mean that lenders review your credit report to determine your credit reliability for things like credit cards, auto loans or mortgages. It will usually affect your score.

A gentle investigation (also known as soft attraction) occurs when you review your own credit report or creditors check your credit report to measure how well you manage your credit. Soft inquiries do not affect your credit score, but they are listed in your credit report.

There is no number of questions that are considered too much, but we advise to minimize your inquiries before applying for a new credit card to increase your likelihood of approval.

You have an account default

The account default results in the main effect. The default indicates that you have not paid your outstanding debt, which will limit you from getting a new credit.

Some examples of defaults are bankruptcy, repossession, seizure and charges. They will be visible on your credit report for up to seven years.

The newly opened account

Opening too many credit accounts in a short period of time can be a red flag. If you have opened a new credit card in the last few months, credit card issuers may need to see more history with your new card before deciding whether or not to provide additional credit.

Waiting for six months between credit card applications is generally recommended. Six months is enough time to prove credit patterns. If six months are too long, we recommend waiting three months at a minimum. Whatever is less than that, and you may face rejection.

Some publishers also have more stringent requirements for their credit cards. For example, Chase’s The famous 5/24 rule states that the applicant is likely to be denied for the card if they have opened five or more cards in the last 24 months.

Related: Best Guide to Credit Card Application Restrictions

How to get approved for the next credit card

There are many ways to build credit to increase your chances of approval.

Build your credit with Experian Stimulus

Experian Boost is the best way to build your credit. This feature uses your bank records to find timely payments for monthly bills that are usually not reported on your credit report. For example, timely utility reporting, rental payments and streaming help improve your Fico score.

Be a authorized user

Being a authorized user is a great tool for those who build their credit from the beginning, especially if the main cardholder has a timely history of payments. In some cases, it can also help you repair your credit due to bankruptcy or missed payments. Sometimes, the only requirement is that authorized users must A specified minimum age.

Get Starter Credit Card

Consider applying a Safe Credit Card to set up or build your credit. Guaranteed credit cards are a good choice if you build or repair credit or if you have trouble approved for a reward card. Alternatively, you can choose a beginner’s reward card with a lower bar for approval.

- If you want higher credit in the first year: Consider Capital Credit Card One Platinum. It has no annual fee and the potential to receive credit increases after six months. When opening any secure card, you will need to pay a cash deposit that will determine your credit limit.

- If you prefer one capital: The Capital One Savor Cash Rewards Card Get 8% cash on Capital One entertainment purchases, 5% cash in hotels and rental cars booked through Capital One Travel and 3% cash back to dining, entertainment, popular streaming services and grocery stores (excluding superstores such as Target and Walmart).

- If you prefer to pursue: The Chase Freedom Unlimited® (See rates and fees) Has an impressive income rate: 5% cash back on Chase Travel℠ purchase, 3% cash back to meal and drugstore purchases and 1.5% cash back on all other purchases. This card will be well installed in the future with Chase Sapphire Card Preferred® (See rates and fees), a more travel -oriented card that requires higher credit scores and established credit history.

Related: Trifecta Chase’s strength: Maximizing your income with 3 cards

Bottom Line

It can be disappointing to be rejected for a credit card, but you can try again. Federal guidelines Require the publisher to give a notice of approval or denial within 30 days of submission of application. Therefore, before anything, note the letter or email detailing the publisher’s decision.

If you are rejected, be patient and solve the problem before applying another card.

If you disagree with the publisher’s decision, you may be Call the phone line his consideration.

Related: How to apply for a credit card